You can download the complete portfolio report including mutual funds & other assets. Get the historical performance of your portfolio easily & track the portfolio at your fingertips.

How a Trusted Financial Advisor Can Guide Your Investments

Founded with the belief that financial planning should be simple, transparent, and accessible, LINEYSHA FINANCIAL SERVICES PVT LTD has grown into a trusted name in Rourkela and Sundargarh. We started our journey by helping families invest in safe products and gradually expanded into mutual funds, insurance, bonds, and loans to cater to every aspect of financial well-being.

Over time, our commitment to client-first service and long-term relationships has helped us serve professionals, entrepreneurs, retirees, and young investors alike.

Our Philosophy

We believe wealth is not built overnight - it is a disciplined journey. Our role is to guide clients through this journey with a structured plan that balances growth, safety, and liquidity. Whether you want to build wealth through SIPs, secure your family with insurance, or preserve savings through fixed deposits, our philosophy remains the same:

“Plan today, Prosper tomorrow.”

-

Our Mission –

Our Mission –To empower every client with the right financial knowledge and solutions, enabling them to achieve their life goals with confidence and discipline.

-

Our Vision –

Our Vision –To be a trusted financial partner in every household by delivering transparent advice, reliable products, and long-term wealth creation strategies.

-

Our Values –

Our Values –We focus on clients first, act with transparency, encourage disciplined investing, and provide continuous support throughout their financial journey.

Lineysha Financial Services Private Limited Services & Solutions

Get Started With

Lineysha Financial Services Private Limited

-

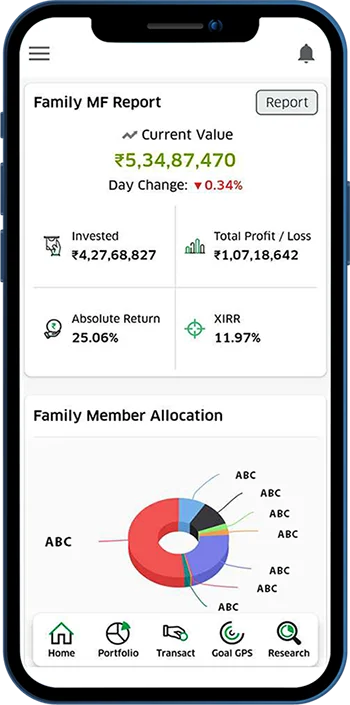

Portfolio Analysis

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.

Build Wealth, Protect Your Family

LINEYSHA FINANCIAL SERVICES PVT LTD is committed to providing personalized financial advisory services. From mutual funds and SIPs to insurance and fixed deposits, we offer solutions tailored to secure your family’s future and help you achieve your financial goals.

Power Of SIP

What Our Investors Says

Rani Singh

I’ve been investing through LINEYSHA FINANCIAL SERVICES for the last 5 years. Their team guided me at every step, from choosing the right mutual funds to planning for my retirement. I feel secure knowing my money is managed professionally

Rahul Kapoor

The personalized approach and transparent advice really set them apart. With their help, I’ve been able to plan for my child’s education while also growing my wealth steadily. Highly recommended!

Priya Desai

Earlier, I was confused about where to invest and how to save tax effectively. Thanks to their guidance, I now have a clear financial plan that gives me confidence about my future.

FAQ

What is SIP?

SIP, or Systematic Investment Plan, is a popular method of investing in mutual funds. It allows investors to contribute a fixed amount at regular intervals, typically monthly. SIPs are designed to make investing easy and affordable for people with different financial goals and risk tolerance.

What is the minimum amount for SIP?

The minimum amount for SIP can vary based on the mutual fund scheme and the fund house. However, many mutual funds offer SIPs with a minimum investment of as low as Rs 500 per month, making them accessible to a wide range of investors.

When is the right time to invest in SIP?

The right time to start a SIP is now. SIP investments benefit from the power of compounding, where your money earns returns on both the principal and accumulated earnings. Time in the market is more crucial than timing the market. By starting early, you give your investments more time to grow.

Contact Us

Rani Singh

I’ve been investing through LINEYSHA FINANCIAL SERVICES for the last 5 years. Their team guided me at every step, from choosing the right mutual funds to planning for my retirement. I feel secure knowing my money is managed professionally

Rahul Kapoor

The personalized approach and transparent advice really set them apart. With their help, I’ve been able to plan for my child’s education while also growing my wealth steadily. Highly recommended!

Priya Desai

Earlier, I was confused about where to invest and how to save tax effectively. Thanks to their guidance, I now have a clear financial plan that gives me confidence about my future.